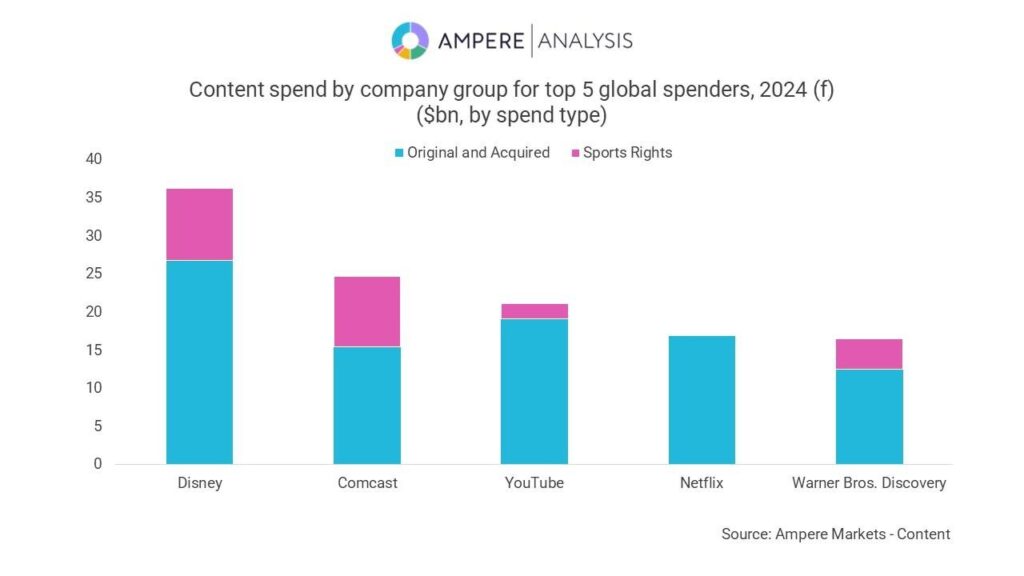

YouTube will be the world’s second largest investor in non-sports content in 2024 based on the earnings it shares with content creators, with only Disney spending more, Ampere Analysis has observed. At nearly $20 billion this year, its content spend will be greater than any VOD-first player, the analyst firm reports after deciding to compare the company’s spending power with major studios and SVOD services.

If sports rights spending is also counted, YouTube will be the third largest content investor worldwide in 2024 and will hold that place for the fourth consecutive year. This ranks the video sharing platform behind Disney and Comcast – with both of these forecasted to spend just over $9 billion on sports rights in 2024.

“YouTube’s total spend is ahead of any VOD-first player and some of the major studios,” the analyst firm emphasizes.

YouTube is the No.1 platform for online video viewing globally and its advertising revenue is driven by its large user base. 83% of all respondents in the Ampere Media – Consumer survey were monthly active users of the platform in Q1 2024, ahead of monthly active video viewers for Netflix (at 57%) and Instagram (at 43%).

YouTube has significantly reduced traditional-style commissioning since 2023 and has few opportunities for re-licensing content on other platforms, but its focus is firmly on funding content creators, Ampere Analysis points out.

YouTube’s advertising revenue alone, forecasted at $35 billion in 2024, exceeds Disney+ and Amazon Prime Video’s total earnings and is just below Netflix’s total revenue. “With a unique business model that places advertising as its main source of revenue – thanks to its huge user base – the platform is rarely compared to TV,” the company adds.

Jaanika Juntson, Senior Analyst at Ampere Analysis, concludes: “YouTube’s unique business model sets the platform apart in the media market yet it plays a key role in the entertainment sector.”